ETH Price Prediction: Will Ethereum Reclaim $4,000 Amid Mixed Signals?

#ETH

- Technical Positioning: ETH trades below 20-day MA but shows bullish MACD divergence, suggesting potential reversal

- Market Catalysts: Mixed news flow with regulatory concerns offset by institutional interest and oversold conditions

- Price Action: $4,000 level serves as critical support/resistance zone with Bollinger Bands indicating consolidation phase

ETH Price Prediction

ETH Technical Analysis: Key Indicators Signal Potential Rebound

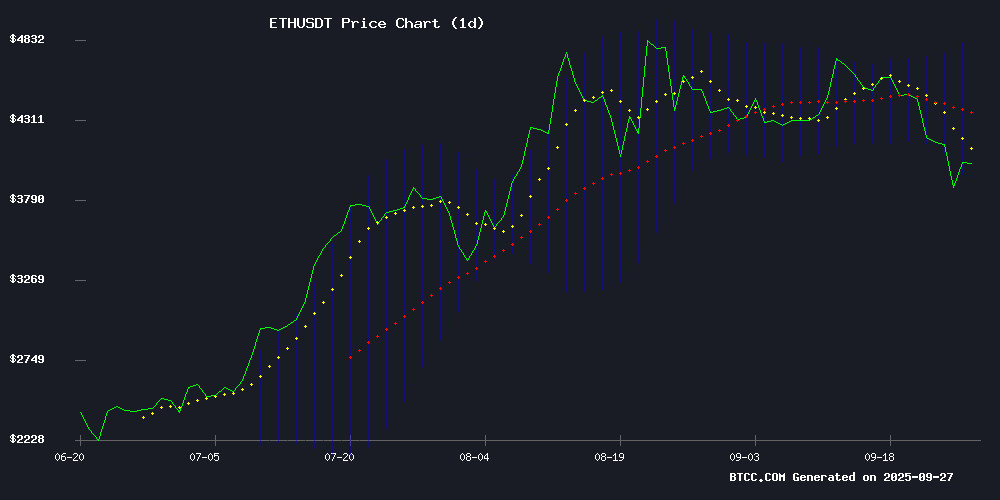

According to BTCC financial analyst William, Ethereum's current price of $4,006.56 sits below the 20-day moving average of $4,371.71, indicating short-term bearish pressure. However, the MACD reading of 153.0068 versus the signal line at 27.1478 shows strong bullish momentum remains intact. The Bollinger Band positioning with current price NEAR the middle band suggests consolidation phase, with upper resistance at $4,830.16 and lower support at $3,913.27.

William notes that 'The technical setup suggests ETH is testing crucial support levels. A hold above $4,000 could trigger upward movement toward the 20-day MA, while breakdown below $3,913 might extend losses.'

Market Sentiment Mixed Amid Regulatory Concerns and Institutional Activity

BTCC financial analyst William comments that 'Recent news FLOW presents contrasting signals for Ethereum. Negative factors include ETF outflows reaching $796 million and regulatory concerns highlighted by Vitalik Buterin's criticism of EU chat control legislation. However, positive catalysts include awakening whale activity with $785 million transfers and oversold conditions suggesting potential rebound.'

William adds that 'The $4,000 level has become a psychological battleground. While short-term pressures exist, the fundamental narrative around Ethereum's roadmap to $6,000 and institutional demand provides underlying support.'

Factors Influencing ETH's Price

Ethereum Co-Founder Vitalik Buterin Criticizes EU's Chat Control Legislation

Vitalik Buterin, co-founder of Ethereum, has issued a sharp rebuke of the European Union's proposed Chat Control legislation, warning it poses significant threats to digital privacy. The regulation would mandate tech platforms to scan private messages for illegal content—a measure Buterin argues undermines security for all users.

"You cannot make society secure by making people insecure," Buterin stated, emphasizing that backdoors for law enforcement create vulnerabilities exploitable by malicious actors. His critique highlights the inherent risks of surveillance infrastructure, which could compromise broader safety rather than enhance it.

Crypto advocates like Hans Rempel and Elisenda Fabrega echo concerns, suggesting such policies may accelerate migration to decentralized Web3 platforms. The debate underscores growing tensions between regulatory oversight and the ethos of privacy in digital ecosystems.

Ethereum’s Road to $6000: Why Testing $3,700 in Q4 2025 Could Define the ETH Price Rally

Ethereum enters Q4 2025 at a critical juncture, with traders watching the $3,700 level as a decisive threshold for its next major rally. Analysts suggest reclaiming this support could pave the way toward $6,000, fueled by institutional interest, growing adoption of Ethereum-based applications, and favorable macroeconomic trends. Failure to hold above $3,700, however, may delay the anticipated breakout.

The ETH price has oscillated between $4,750 and $4,270 after breaking past $3,876 and stabilizing above $4,200. Recent bearish pressure has pushed it toward $4,000, with market sentiment turning neutral to bearish. Traders appear poised to exploit liquidity around key support levels.

Coinglass data reveals a concentration of long liquidations between $3,700 and $3,800, signaling potential downward pressure. The coming weeks will test whether Ethereum can sustain momentum or face further consolidation.

Ethereum Struggles to Hold $4,000 Amid ETF Outflows and Selling Pressure

Ethereum's recovery falters as institutional demand wanes, with $796 million flowing out of ETH ETFs this week. The cryptocurrency hovers near $4,000, but long-term holders are offloading positions, pushing the Liveliness metric to a 2023 high.

Key support at $3,875 is under threat. Without renewed buying interest, ETH risks testing $3,626 or lower. The modest 1% gain appears fragile against broader bearish signals.

Market observers note a troubling divergence: while the crypto sector shows tentative signs of recovery, Ethereum faces unique headwinds from both institutions and long-term investors. The ETF outflows suggest cooling appetite among traditional finance players.

Ethereum Market Slump Spurs Demand for Stable Yield Alternatives

Ethereum faced intensified selling pressure in late September amid a broader cryptocurrency market downturn. Dubbed "Red September," the slump erased an estimated $160 billion in market value across digital assets. ETH briefly touched $4,000 before recovering to $4,200, settling at $4,177 on September 24—a 7% weekly decline according to CryptoNews data.

Seasonal weakness, dollar strength, and regulatory uncertainty contributed to the pullback. Investors are increasingly seeking stable income streams beyond price speculation. BAY Miner, a regulated cloud mining platform, has emerged as a solution offering USD-denominated daily payouts—providing ETH holders with predictable cash flow regardless of market volatility.

Cloud mining eliminates hardware requirements by allowing users to rent hash power from professional data centers. The model converts upfront capital expenditures into operational expenses while maintaining cryptocurrency exposure. Daily automated payouts—often distributed in crypto or fiat—provide consistent returns without active management.

Vitalik Buterin Warns EU’s Chat Control Could Break Digital Privacy: “Fight It”

Ethereum co-founder Vitalik Buterin has criticized the European Union’s proposed "Chat Control" legislation, arguing it undermines online privacy. The regulation, formally known as the Child Sexual Abuse Regulation (CSAR), would mandate scanning of private messages across encrypted platforms like WhatsApp and Signal, as well as email services and gaming chats. Proponents claim it targets child protection, but opponents view it as a veiled mass surveillance measure.

Buterin’s stance reflects broader concerns in the tech community. "You cannot make society secure by making people insecure," he posted on X. The debate hinges on whether such invasive measures justify their purported security benefits, with implications for over 450 million EU citizens and potential global ripple effects.

Ethereum ETF Outflows Reach $796M Amid Price Decline, Key Support Levels Tested

Ethereum's market position weakened significantly as spot ETF outflows totaled $795.8 million over five consecutive days. The selling pressure accelerated on Friday with single-day redemptions hitting $248.4 million, marking the worst outflow streak since early September.

The cryptocurrency currently trades at $4,013, reflecting a 10.25% weekly decline and 12.24% monthly drop. Technical analysts observe a breakdown from triangle consolidation, with the 20-week moving average near $3,500 emerging as the next likely target. Critical immediate support holds at $4,060 - a level whose breach could trigger accelerated declines.

Despite bearish momentum, some traders view current prices as accumulation opportunities near higher timeframe support zones. Market participation metrics show weakening retail interest, with Binance's net taker volume remaining negative throughout the downturn.

Ethereum Reclaims $4,000 Amid Institutional Demand and Whale Activity

Ethereum surged past $4,000, recovering from a week of volatility as institutional inflows and strategic whale accumulation countered oversold conditions. The rally reflects growing confidence in ETH's long-term value proposition.

Vanguard's entry into crypto ETFs—following BlackRock's $254 million single-day inflow—signals deepening institutional adoption. With ETH's market cap at $485 billion, ETF-driven demand creates disproportionate buy pressure. ETH ETF assets under management jumped 57% to $18.4 billion in 30 days, with SEC decisions on pending filings poised to catalyze further upside.

Whales deployed $2 billion during dips near $3,900, including a $503 million OTC purchase and $661 million staked in 24 hours. This accumulation suggests strong conviction at current levels despite macroeconomic headwinds.

Top 5 Free Ethereum Cloud Mining Platforms of 2025: AIXA Miner Leads with $20 Bonus

Ethereum continues to dominate as the preferred cryptocurrency for passive income in 2025, driven by its pivotal role in DeFi, NFTs, and enterprise blockchain adoption. Traditional mining hurdles—high GPU costs, energy consumption, and hardware degradation—are being circumvented by the rise of cloud mining platforms.

AIXA Miner tops the list of free Ethereum cloud mining solutions, offering seamless operation, security, and a $20 bonus for new users. The platform exemplifies the industry's shift toward hassle-free, contract-based mining with automated payouts and tiered subscription models.

Other contenders in the top five remain unnamed in this excerpt, but the trend is clear: cloud mining is reshaping Ethereum's accessibility, transforming it from a resource-intensive process into a streamlined revenue stream for global investors.

Dormant Ethereum Whales Awaken, Transfer $785 Million in ETH After Eight Years

Two long-dormant Ethereum wallets linked to an early Bitfinex user suddenly sprang to life, moving 200,000 ETH worth over $785 million after eight years of inactivity. Lookonchain analysts identified the addresses as belonging to an Ethereum pioneer who now controls 736,000 ETH ($2.89 billion) across eight wallets.

The transfers triggered speculation among crypto observers. "Sleeping whales MOVE not to sell but to scare," remarked pseudonymous analyst FOMOmeter. "These maneuvers create panic that enables accumulation at lower prices."

Institutional interest in Ethereum appears to be intensifying. Sixteen wallets received 431,000 ETH ($1.7 billion) from major platforms including Kraken, Galaxy Digital, and OKX in just 72 hours. The movement follows another significant reactivation last week when a separate whale moved 11,104 ETH after similar dormancy.

Ethereum Signals Rare Oversold Condition, Hinting at Potential Rebound

Ethereum's Relative Strength Index has plunged to 14.5 on the four-hour chart, marking its most oversold condition since April 2025 when ETH traded near $1,400. The cryptocurrency now faces a critical test at the $3,900 support level.

Historical patterns suggest such extreme RSI readings often precede significant rallies. The current reading represents only the 19th instance of sub-15 RSI in the past decade, with the September 26 reading showing a dramatic drop from September 13's overbought 82 level.

Traders are monitoring for potential bullish reversal signals, with a sustained hold above $3,900 potentially paving the way for a rally toward $4,100. The speed of the transition from overbought to oversold conditions has drawn particular attention from technical analysts.

Centrifuge Launches First Licensed Tokenized S&P 500 Fund on Base Network

Centrifuge has introduced SPXA, the first licensed tokenized S&P 500 index fund on the Base blockchain, marking a significant milestone in the convergence of traditional finance and decentralized technology. The fund, managed by Janus Henderson and Anemoy with FalconX as anchor investor, enables 24-hour trading access to the S&P 500 index, a benchmark tracking 80% of the U.S. equity market.

The launch on Base, an Ethereum Layer-2 network developed by Coinbase, represents the first blockchain-based index fund officially licensed by S&P Dow Jones Indices. Wormhole's integration will facilitate future multichain expansion, potentially increasing accessibility across decentralized finance ecosystems.

This innovation addresses a key limitation of traditional index funds by providing continuous market access while maintaining transparency through blockchain-recorded holdings. The move signals growing institutional acceptance of tokenized assets as viable investment vehicles.

Will ETH Price Hit 4000?

Based on current technical and fundamental analysis, ETH is actively testing the $4,000 level. The probability of maintaining or exceeding this level depends on several key factors:

| Factor | Bullish Signal | Bearish Signal |

|---|---|---|

| Technical Indicators | MACD shows bullish momentum | Price below 20-day MA |

| Market Sentiment | Oversold conditions, whale activity | ETF outflows, regulatory concerns |

| Key Levels | Support at $3,913 holding | Resistance at 20-day MA ($4,371) |

As William from BTCC notes, 'The $4,000 level represents a critical psychological threshold. Current data suggests a balanced battle between bulls and bears, with technical indicators favoring a potential rebound if support holds.'